VIDEOS

ARTICLES

The SOM Experience — Yale School of Management

Mary Ellen Iskenderian ’86 had spent decades working in global finance before she became the president and chief executive officer of Women’s World Banking, which works to make financial resources accessible to low-income women in developing countries. But when she was recruited for the position in 2006, she realized that over the course of her career, including 17 years at the International Finance Corporation (IFC), she had never asked a banker about gender equality issues.

Iskenderian had experienced gender disparities in her own career—she had been one of only two women currency traders in her first job after college—but “I didn’t have a gender focus,” she remembers. After gender appeared in the frame, however, it dominated her view.

“Once you see the differences, you can’t unsee that,” she says.

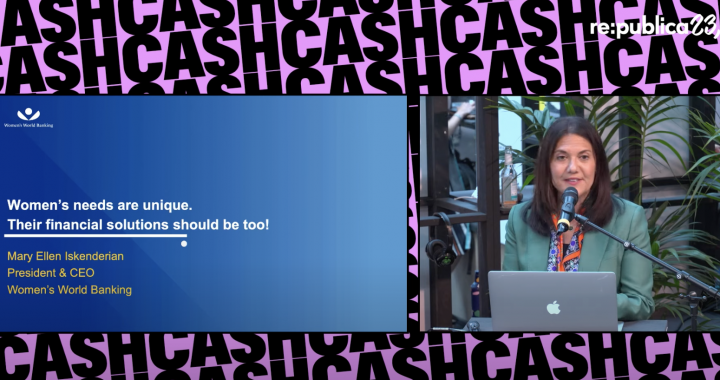

Mary Ellen Iskenderian Wants Financial Inclusion for 750 Million Women — The Suite

The President and CEO of Women’s World Banking is helping low-income women access formal financial services – and it’s a $700 billion opportunity for the banks, fintechs and other businesses that are willing to get on board.

Mary Ellen Iskenderian is describing her offices at Women’s World Banking, the global non-profit of which she’s President and CEO. Based in midtown Manhattan, across the road from Grand Central Station, she’s on the 42nd floor of a beautiful, historically preserved building, with one view of the Chrysler Building, and another that runs all the way downtown. “It’s a really lovely space… that no one wants to come and work in any longer!” she exclaims, laughing. “It seems everyone wants to work from home these days.”

The path to financial inclusion for women — idr Hindi

Mary Ellen Iskendarian and Kalpana Ajayan on India's progress towards financial inclusion for women, the gaps that need to be addressed, and the role of digital literacy.

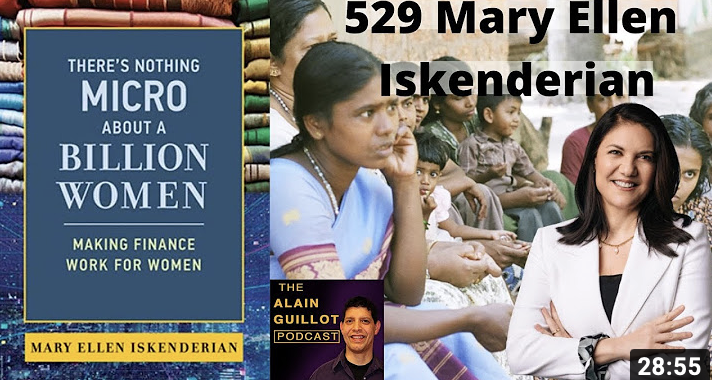

Women’s Financial Inclusion - Time To Ignore Men (and Their Data) — Forbes

In today's world, many problems can be traced back to the desire for power, which is often associated with male ego. Power often leads to conflicts, and these conflicts usually revolve around a man or a group of men seeking to exert control over others. However, power alone isn't enough - money plays a crucial role in perpetuating this power dynamic. To understand how men maintain their power - intentionally or otherwise, we need to follow the money.

This article isn't an investigative expose on megalomaniacs and their financial dealings. Instead, inspired by a conversation with Mary Ellen Iskenderian, CEO of Women’s World Banking (WWB) and author of "There’s Nothing Micro about a Billion Women" I focus on why men find it easier to access financial resources compared to women and how artificial intelligence (AI) can both help and hinder women's financial inclusion.

Power in Number — Life Style Magazine

Women’s World Banking CEO, Mary Ellen Iskenderian, is changing the game for low-income women.

I have been a banker, of one kind or another, for my entire career. I started in Bank of America’s credit training program, followed by a short stint in the bank’s international trade finance group before jumping to the fast-paced, foul-mouthed foreign currency trading desk. After earning my M.B.A., I joined the mergers and acquisitions de- partment at the investment banking firm Lehman Brothers. I had taken these jobs quite deliberately, convinced that I could hone my finance skills working with investors, banks, and governments to drive positive change in the developing world.

How can fintech innovation supercharge global women's development? — Context

Mary Ellen Iskenderian, CEO of Women’s World Banking and Graham Macmillan, President of the Visa Foundation, discuss how the pandemic has supercharged fintech innovation, but without thoughtful implementation we risk reinforcing old biases and inequalities and failing to serve women’s needs.

The U.S. Gender Pay Gap Impacts Women throughout their Lives — Mary Ellen Iskenderian

Last Tuesday, March 8th, we celebrated International Women’s Day, recognizing the leadership and accomplishments of women around the world. So, there is more than a little irony in the fact that just one week later, Tuesday, March 15th, is #EqualPayDay here in the United States. And this, I’m afraid, is not a cause for celebration, because Equal Pay Day represents just how far into the new year the average American woman would have to work before she earned the same amount that the average American man was paid last year.

Leadership Insights: A series from FinEquity’s Technical Advisors

The business case for economically empowering women is clearer than ever with the data to back it up. So why does a $700 billion opportunity continue to be a side conversation instead of a global game changer? Mary Ellen discusses why it's time to use these insights and data to make meaningful policy changes and create new products and services that work for women.